You picked up your prescription for levothyroxine, expecting to pay $5 like last month. But the cashier hands you a bill for $45. You ask why. They say it’s still the same generic drug. You’re confused. You thought generics were supposed to be cheaper. Tiered copays are why.

How Your Prescription Got Put in the Wrong Tier

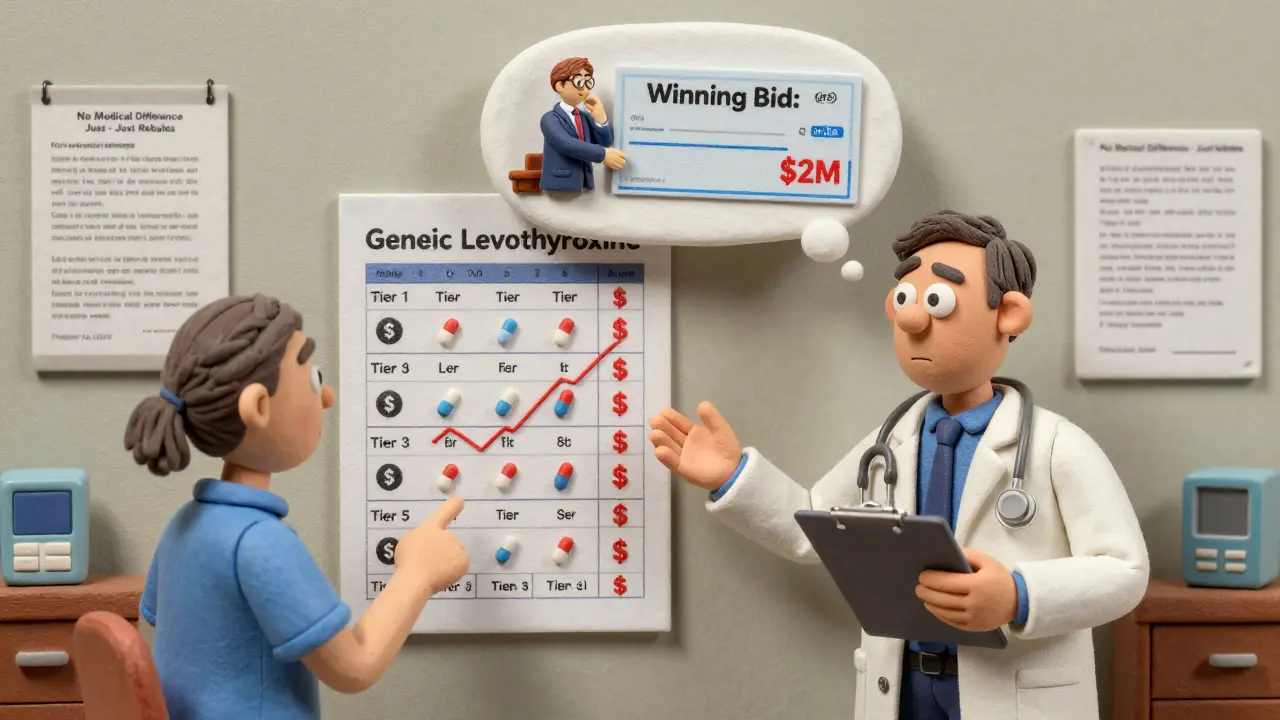

Most health plans don’t charge the same amount for every drug. Instead, they sort medications into tiers - like levels in a video game - and each level has its own price tag. Tier 1 is usually the cheapest. That’s where you find the most common generics: drugs like metformin, lisinopril, or atorvastatin. These are the workhorses of medicine, and insurers want you to use them. So they make them cheap - sometimes even free. But here’s the twist: not all generics are in Tier 1. Some are in Tier 2, Tier 3, or even higher. And yes, that means you could pay more for a generic version of the same drug your neighbor takes for $5. It’s not a mistake. It’s by design. The reason? It’s not about the drug. It’s about money. Pharmacy Benefit Managers (PBMs) - companies like CVS Caremark, Express Scripts, and OptumRx - negotiate deals with drug makers. They get rebates, discounts, and kickbacks. The drug that gives the PBM the biggest rebate gets placed in Tier 1. The one that doesn’t? It gets bumped up, even if it’s chemically identical. A 2023 analysis by BOC Pharmacy Group found that 12-18% of generic drugs are classified as specialty medications and placed in higher tiers - not because they’re complex, but because the manufacturer didn’t pay enough to the PBM. Your levothyroxine? Same active ingredient. Same safety record. But if the maker didn’t cut a good deal, you pay more.Why Your Doctor Can’t Fix It

You go to your doctor. You say, “Why is this generic so expensive?” They shrug. “All generics are the same.” And they’re right - from a medical standpoint. But your insurance doesn’t care about that. It cares about the contract between the PBM and the drug company. Your doctor can’t override the tier. They can’t force your insurer to cover it at a lower price. All they can do is write a new prescription - maybe for a different generic that happens to be in Tier 1. But that’s not always easy. Some drugs only come in one formulation. Others have slight differences in fillers or coatings that make switching risky for patients with allergies or sensitivities. In 2024, a study from the Medicare Rights Center found that 63% of therapeutic interchange requests - where a doctor asks to switch a patient to a lower-tier drug - were approved. But that still means nearly 4 in 10 patients got stuck paying more.Specialty Generics Are the New Problem

The biggest shift in recent years? Generics for complex, expensive drugs are now being tiered too. Take adalimumab - the generic version of Humira. It treats rheumatoid arthritis, psoriasis, Crohn’s disease. It costs $5,000 to $10,000 a month. The generic version? Still costs thousands. But now, instead of being covered under a single specialty tier, insurers are creating sub-tiers within specialty drugs. One generic version might be in Tier 4 with 20% coinsurance. Another, from a different manufacturer, might be in Tier 5 with 35% coinsurance. Patients don’t know the difference. They’re told, “This is the generic.” But the pharmacy dispenses the one with the lowest rebate - not the one that’s best for them. And if they don’t catch it, they’re stuck paying hundreds more per month. In 2023, the Patient Advocate Foundation surveyed 1,200 people. Over 40% had been hit with a higher-than-expected generic copay. Two-thirds said their insurer gave no clear explanation.

How to Fight Back

You don’t have to accept it. Here’s what works:- Check your formulary - every plan publishes a list of drugs and their tiers. Look it up on your insurer’s website. It’s updated every October for Medicare plans, but commercial plans can change anytime. Don’t assume last year’s list is still right.

- Use tools like GoodRx or SmithRx - they show you the cash price and the tiered copay side by side. Sometimes, paying cash is cheaper than using your insurance.

- Ask your pharmacist - they know which generics are in which tier. If you get a different pill than usual, ask: “Is this the same as last time? Is it in a different tier?”

- Request a tier exception - if your drug moved up and you’re stable on it, file a formal appeal. You’ll need a letter from your doctor saying the switch would harm your health. Many are approved, especially for chronic conditions like diabetes or thyroid disease.

- Look for manufacturer coupons - companies like Amgen and AbbVie offer savings cards for their generics. Even if your insurance won’t cover it, these can drop your cost by 50-80%.

Why This System Still Exists

Insurers say tiered copays save money. And they’re not wrong. Studies show tiered systems reduce overall drug spending by 8-12%. Patients switch to cheaper options. More generics get used. Costs go down. But the cost savings don’t always reach you. The savings go to the insurer and the PBM. You’re left paying more for the same drug because the rebate went to someone else. Dr. Aaron Kesselheim from Harvard put it bluntly: “Tiering generics differently undermines the whole point of generics.” The system was built to encourage smart choices. But now, it’s confusing, inconsistent, and often unfair. A drug that’s chemically identical to another can cost twice as much - not because of quality, but because of a contract signed in a boardroom.

What’s Changing in 2025 and Beyond

The Inflation Reduction Act caps out-of-pocket drug costs at $2,000 a year for Medicare Part D starting in 2025. That’s a big win. But it doesn’t change the tiers. You could still pay $45 for your generic - just not more than $2,000 total for the year. Some lawmakers are pushing bills to limit tier complexity. The bipartisan Prescription Drug Pricing Reduction Act would require insurers to justify why a generic is in a higher tier. No more hiding behind “negotiated rebates.” For now, though, the system stays. And you’re still the one paying the difference.What to Do Next

If you’re paying more than you expect for a generic drug:- Log into your insurance portal and pull up your formulary.

- Search for your drug by name. Note the tier.

- Call your pharmacy and ask: “Is this the same generic I got last month?”

- If it changed, ask your doctor to file a tier exception.

- Check GoodRx for cash prices. Sometimes, paying out of pocket saves you money.

- Search for patient assistance programs on the drugmaker’s website.

Why is my generic drug more expensive than the brand-name version?

It’s rare, but it can happen. Brand-name drugs are often in Tier 2, while some generics are in Tier 3 or higher due to low rebates from the manufacturer. If your brand-name drug is in Tier 2 with a $50 copay and your generic is in Tier 3 with a $65 copay, the generic is being penalized for not having a good rebate deal - not because it’s less effective.

Can my pharmacist switch my generic without telling me?

Yes, in many states, pharmacists can substitute a preferred generic without notifying you - even if your doctor didn’t specify it. This is called an automatic interchange. Always check the pill when you pick it up. If it looks different, ask why. You have the right to refuse the substitution.

Do all insurers use the same tiers?

No. Each insurer - and even each plan within an insurer - has its own formulary. A drug in Tier 1 with Humana might be in Tier 3 with UnitedHealthcare. Always check your specific plan’s list. Don’t assume your friend’s coverage works the same way as yours.

Why do some generics cost more than others for the same drug?

Different manufacturers make the same generic drug. One might have a better rebate deal with your PBM, so it’s in Tier 1. Another, made by a different company, has no rebate - so it’s in Tier 2. The pills are identical, but the pricing isn’t. It’s all about contracts, not quality.

Will the $2,000 cap in 2025 fix this problem?

It will cap your total spending, but not your per-prescription cost. You could still pay $75 for a generic that should cost $15. The cap just means you won’t pay more than $2,000 total for drugs in a year. The tier system stays - and so does the confusion.

How often do formularies change?

Medicare plans update every October. Commercial plans can change anytime - often in January or July. In 2023, 17% of employer plans changed their formularies between January and June. Always check your formulary at the start of each year and after any major life change.

What’s the difference between a preferred and non-preferred generic?

There’s no medical difference. “Preferred” means the drug maker paid the PBM a big rebate. “Non-preferred” means they didn’t. The pills are the same. The price isn’t. It’s a financial decision, not a clinical one.

Can I get my drug covered if it’s not on the formulary?

Yes. You can file a formulary exception request. You’ll need a letter from your doctor explaining why you need this specific drug - not just any generic. Many are approved, especially for chronic conditions. Don’t give up if you’re denied the first time.

Beth Templeton

January 6, 2026 AT 19:36Isaac Jules

January 6, 2026 AT 22:58Molly McLane

January 6, 2026 AT 23:40Amy Le

January 8, 2026 AT 02:53Ryan Barr

January 8, 2026 AT 23:24Leonard Shit

January 9, 2026 AT 10:46Vinayak Naik

January 9, 2026 AT 10:49Pavan Vora

January 10, 2026 AT 21:13Brian Anaz

January 12, 2026 AT 18:00Rachel Wermager

January 14, 2026 AT 15:54Venkataramanan Viswanathan

January 15, 2026 AT 19:12Ashley S

January 17, 2026 AT 06:48Tiffany Adjei - Opong

January 19, 2026 AT 02:14Dana Termini

January 19, 2026 AT 15:22